What Is Fund Accounting

The term fund accounting could refer to the method of accounting used by some not-for-profit organisations such as churches, charities, universities. If you’re interested in that, go somewhere else. That’s not what we’re about here.

Investment Accounting

Fund accounting also means the methods of accounting used by investment funds. It’s sometimes called investment accounting or investment fund accounting. To be more specific, one could use terms such as

- Mutual fund accounting

- Hedge fund accounting

- Private equity fund accounting

Fund Accounting Basics

Some aspects of the role of the fund accountant are similar to the role of a regular (!) or corporate accountant. The fund accountant

- Recognises income and expenses on an accruals basis

- Verifies accounting records to external sources

But there are many elements of investment fund operations that are clearly different to those of a corporate enterprise. Open-ended investment funds, such as mutual funds and hedge funds, can involve

- Regular and frequent cash inflows and outflows from and to fund investors

- A portfolio of financial investments that are typically measured at fair value

- A net asset valuation, or NAV calculation, completed daily, weekly or monthly

What does a fund accountant do

The fund accountant’s role involves capturing and recording this activity and calculating the NAV. A fund accountant job description might outline the following fund accountant responsibilities:

- Account for capital activity (subscriptions and redemptions)

- Calculate and/or monitor expense accruals

- Process expense payments

- Account for fund income

- Process and/or monitor corporate actions

- Price financial instruments

- Reconcile cash and portfolio positions to custody/broker records

- Calculate the NAV

- Prepare investor and regulatory reporting

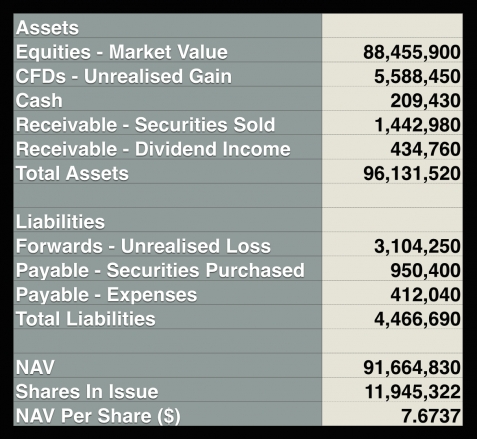

NAV = Assets less Liabilities

NAV Calculation

The net asset valuation is just like a statement of assets and liabilities. If the fund is unitised, that is, it issues units or shares to investors, then a NAV per share is calculated as well as the total NAV.

Here is a summary sheet outlining a NAV calculation for a mutual fund.

If the fund is a partnership, no shares or units are issued and the NAV consists of an allocation of fund gains/losses across the partnership capital accounts.

If you’d like to learn more about fund accounting, watch the fund accounting tutorial 7-minute video here.