Private Equity Fund Accounting – Equalisation Interest

This is the fifth in a series of posts on private equity fund accounting.

For the fourth post, Subsequent Closings & Equalisation, click here.

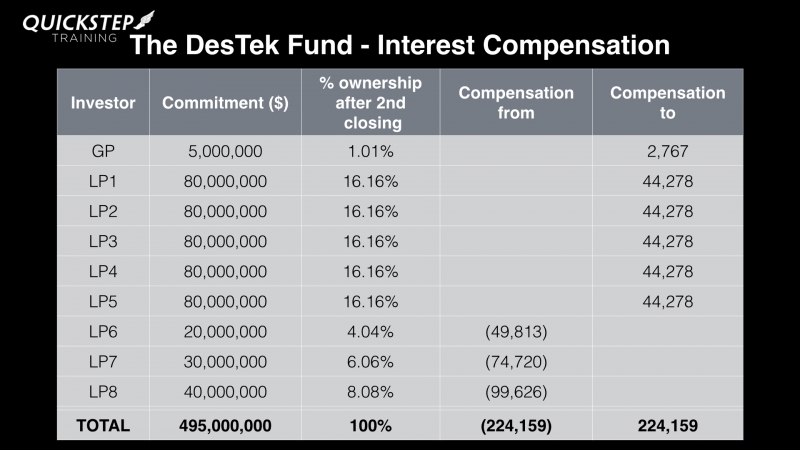

My previous post outlined private equity accounting when there is a subsequent closing and, in particular, what is meant by equalisation (the ‘true-up'). This quick post looks at the interest compensation charge incurred by the subsequent investors.

The subsequent investors are required to compensate the initial investors for the fact that the initial investors have had their capital tied up in the fund for longer. This is an interest compensation charge and it is based on the capital amount from the subsequent investor, an agreed interest rate, time apportioned for the time between the initial and the subsequent closing.

This equalisation interest is not due to the fund. It is incurred by the subsequent investors and paid to the initial investors. More broadly, it is paid by the last round of new investors to all the earlier investors who have previously paid in capital.

From the fund documentation…

The DesTek Fund rules provide for subsequent investors to pay an interest compensation charge of 6%. If LP8 paid in $4,040,404 on 30th June, he needs to compensate the initial investors to the tune of $4,040,404 at 6% for the period between January 31st and 30th June, 150 days. That is,

$4,040,040 x 0.06 x 150/365 = $99,626.

The total amount of compensation is then allocated across the initial investors, according to the table below.

Fund documentation might outline that equalisation interest must be calculated using a fixed percentage as shown above. Or reference might be made to a market rate of interest plus a number of basis points, for example, LIBOR + 400bps.

For my next post, I'll address the Excused Investor.