Fund Accounting Essentials in 2020

Here's some background to fund accounting and the NAV.

It accompanies the video you can watch here.

Open-ended investment funds are funds that allow individuals and institutions to invest in, or take their money out of, the fund on an ongoing basis. Funds might permit this on a daily, weekly, monthly, quarterly or less frequent basis. Let’s assume we have here a daily dealing fund. This fund allows the investor to invest cash today and withdraw cash any day after today. The investor could have money in the fund for years or could withdraw cash next week.

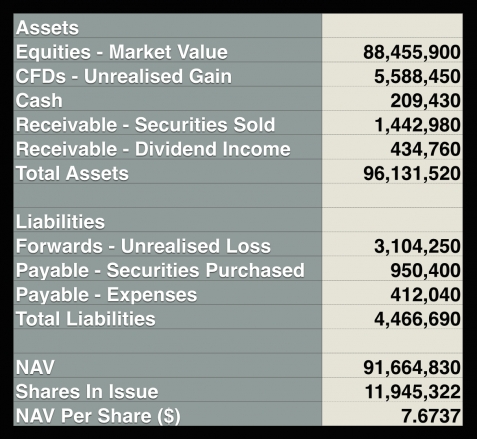

If I invested $100,000 a week ago and want to withdraw all my money now, how much do I get? What is my investment worth now? This daily dealing fund must be able to tell me, the investor, what my investment is worth on any given day. So the value of the fund must be calculated on a daily basis. The fund must sum up the value of everything it owns, subtract the value of everything it owes and so calculate a net asset value, a NAV. The NAV calculation determines how much the investor gets when they withdraw some of their investment.

How we get from that total fund NAV to my share of the fund depends on how the fund is structured. If the fund is established as a partnership, partnership accounting will allocate gains and losses to my account and on any day the net asset value of my account can be ascertained. If the fund is set up as a company or as a trust it will be unitised. This means that investors are given units or shares in the fund at the time they invest. These shares have a value, a NAV per share. The NAV per share changes over time. The NAV per share at the time of my investment determines how many shares I’m allotted. The NAV per share at the time I withdraw my cash determines how much I get paid.

The NAV is the basis upon which investors invest or withdraw cash to or from a fund. It ensures that investors share the gains or losses equitably. Therefore its accuracy is hugely important.

Fund accounting refers to the maintenance of the financial records of an investment fund. Accounting records must be kept for the investor activity, the portfolio activity, the income earned and the expenses incurred by the fund. In addition, the instruments held by the fund must be valued regularly and fund accounting records these changes in value.

The fund accounting for this activity forms the basis for the net asset valuation and for the preparation of periodic financial statements. Our focus is on the NAV calculation.

What is the NAV cycle?

- Cash is invested into a fund

- The fund issues shares to an investor.

- The fund then makes investments in various financial instruments, earns income and incurs expenses

- The net asset valuation is calculated.

- The NAV per share is the basis upon which subsequent investments and withdrawals are processed.

- So the NAV per share determines the number of shares issued to investors and the amount of cash paid to investors

That is the NAV cycle.

The NAV is the assets of the fund minus the liabilities of the fund. It’s calculated so the fund knows how much to pay investors when they withdraw their investment; and to know how many shares to issue to new investors. It is also used to report fund performance.

To learn more about mutual fund accounting and hedge fund accounting click here.